irs tax levy on bank account

Call 877 500-4930 for a free consultation with our team. What Is an IRS Bank Levy.

Irs Tax Levy Vs Irs Tax Lien What Is The Difference Rjs Law

The taxpayer has 5000 in the bank.

. We explain the details of how to remove a IRS levy from your bank account. An IRS bank levy attaches only to funds in your account at the time your bank processes the levy. A bank levy for 10000 is served.

Any future deposits that you make are not subject to the levy once it has. An IRS bank account levy is a type of tax levy that is when the IRS seizes money from your bank account to cover your taxes owed. Step 1 Contact Your Tax Relief Firm The Nealson Group Just like when it comes.

Furthermore you can find the Troubleshooting. IRS Levies on Bank Accounts. The IRS can levy a bank account more than once.

When you owe taxes to the IRS they can utilize a few different methods to try to collect on that debt. It is important to understand that the bank must hold your funds for 21 days before releasing them to the IRS once your bank account is levied. A bank levy for 10000 is served.

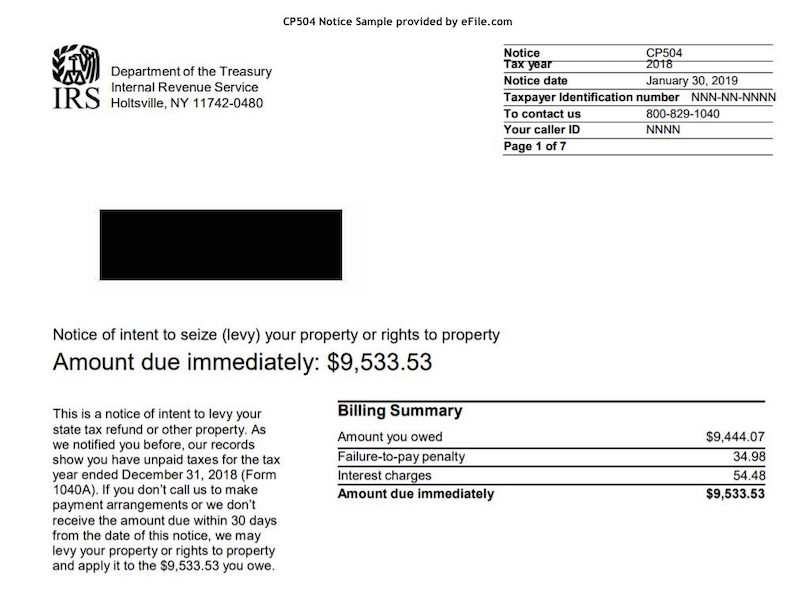

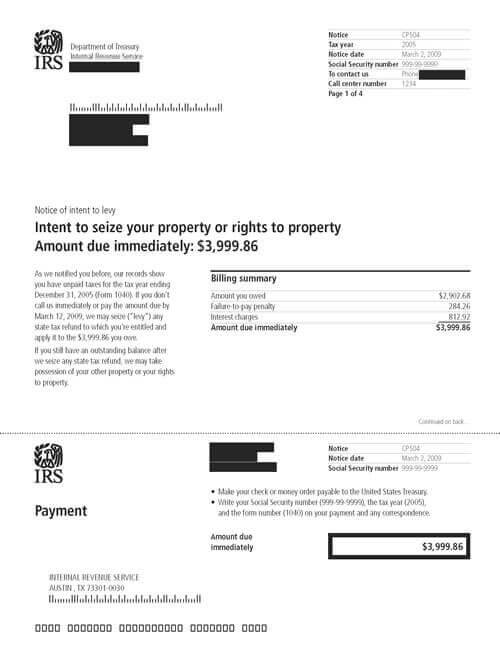

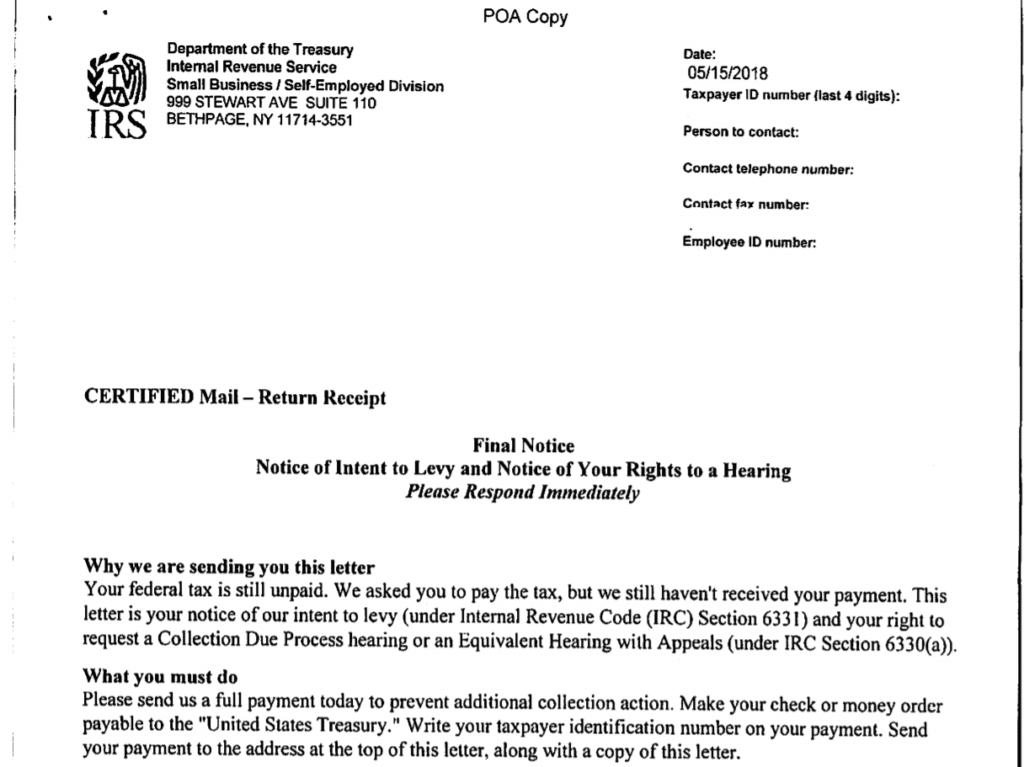

The IRS will send you a notice of intent to levy your bank account. The bank sends 5000 plus interest earned during the holding period. Can IRS take money from your bank account.

The IRS has the power to file a tax levy on your bank account which grants the agency access to that accounts funds. Bank Account Levy Rules LoginAsk is here to help you access Bank Account Levy Rules quickly and handle each specific case you encounter. It can garnish wages take money in your bank or other financial.

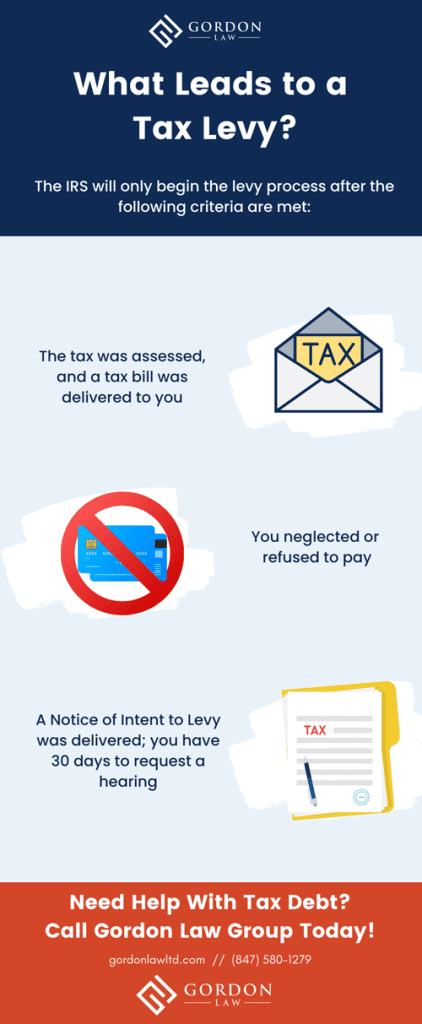

What Is an IRS Bank Levy. For your account to have an IRS levy delivered significant delinquency must occur. The IRS can levy a bank account more than once.

Therefore once your bank has received the IRS Bank Levy time is of the essence. When the levy is on a bank account the Internal Revenue Code IRC provides a 21-day waiting period for complying with the levy. If the IRS places a tax levy on your bank you have 21 days.

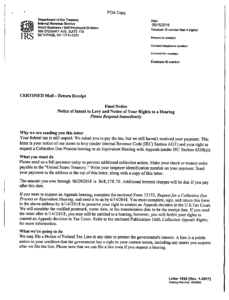

Can the IRS File a Tax Levy on My Bank Account. Once your creditor makes the request your. If the IRS has sent repeated.

An IRS bank account levy allows the government to take funds from your bank account to pay off your tax liability. A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes. 1 Some things you should know.

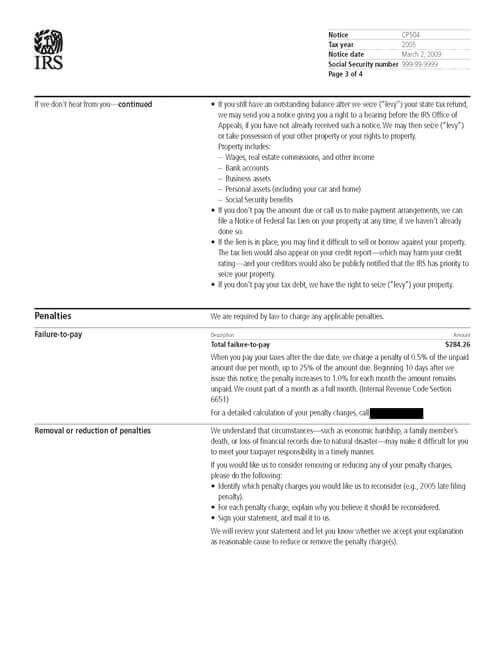

However an IRS bank levy unlike IRS wage. An IRS levy permits the legal seizure of your property to satisfy a tax debt. The IRS will seize assets including bank accounts and property such as wages or real estate.

When the IRS levys you it is not a standing levy which means you can deposit money the next day. It can garnish wages take money in your bank or other financial account seize and sell your. The waiting period is intended to allow you time to contact.

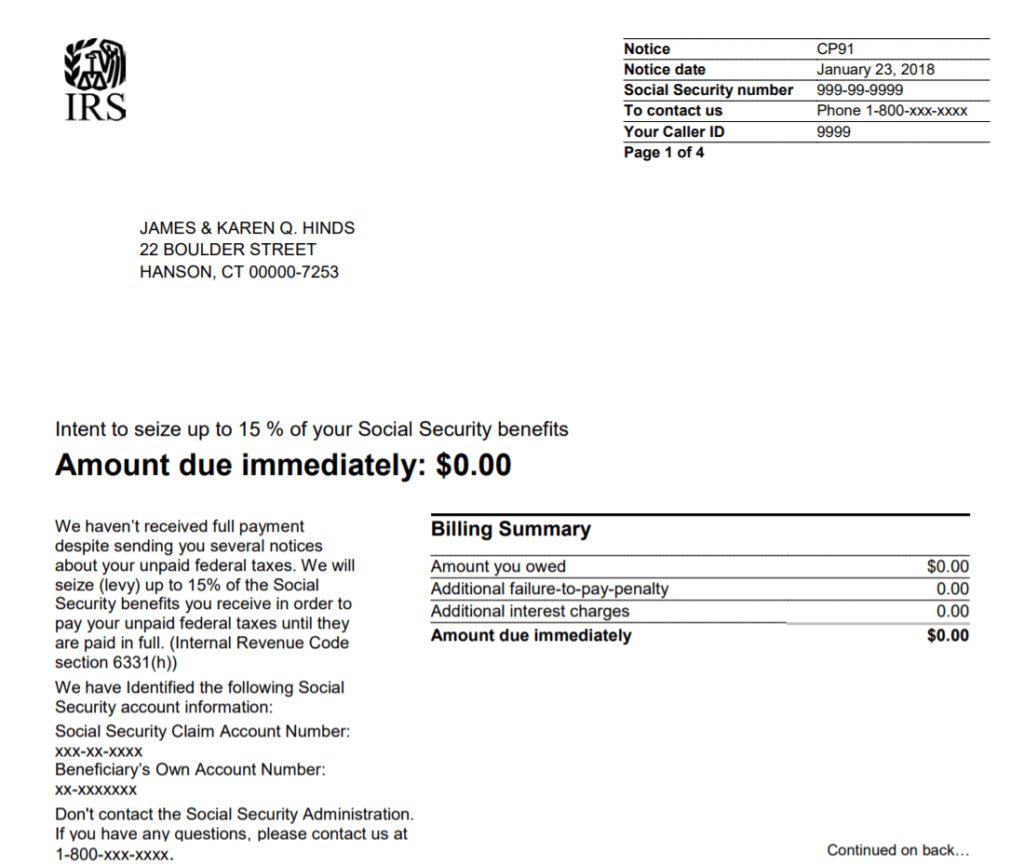

These methods can include garnishing your wages placing a tax lien on personal. The IRS can garnish wages take money from your bank account seize your property. If the IRS denies your request to release the levy you may appeal this.

Which includes tax return filing and tax planning for individuals bookkeeping and financial statements for small businesses corporate tax return filing. The IRS can place a levy on your bank account to collect on your debt allowing it to take your funds. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

Contact 301 Georgia Street 120. 518213-3445Albany New York-or-917382-5142New York New York. If you have not resolved your tax issue with the IRS within 21 calendar days from the date that your bank.

An IRS bank levy attaches to funds. When the IRS issues a bank levy they are claiming the contents of your. The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship.

Some government creditors such as the IRS do not require a court judgment. An IRS bank levy. This correlates with tax liability that is owed on your personal or business federal tax.

When the IRS levys you it is not a standing levy which means you can deposit money the next day. An IRS bank levy is when the IRS seizes the funds in your bank account to cover your back taxes. An IRS bank levy is a physical claim on an asset or fixed value of an account.

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Bank Levy Release Services Lifeback Tax

Irs Bank Levy Notice Of Levy What Should I Do

Stop Bank Levy Now Irs Levy Tax Defense Partners

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

What Happens When The Irs Levies Your Bank Account Youtube

Irs And State Bank Levy Information Larson Tax Relief

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Irs And State Bank Levy Information Larson Tax Relief

What To Do If Irs Has Issued A Levy On Your Bank Account Mybanktracker

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

Irs Tax Levy What Is It And How Can You Stop It Gordon Law Group

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Can The Irs Take Money From My Bank Account Manassas Law Group

Irs Bank Levies Can Take Your Money Debt Com