does nh tax food

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. Unusually amongst states that have no.

Understanding California S Sales Tax

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055.

. New Hampshire Sales Tax Rate. If you have any questions about tax exempt sales please call the Department for clarification at 603 230-5920. Concord NH 03305 603 271-2382 Who pays it.

There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. A 7 tax on phone services. The 8080 rule applies when 80 of your sales are food and 80 of the food you sell is taxable.

A 9 tax is also assessed on motor vehicle rentals. AP South Dakota Gov. New Hampshire is one of the few states with no statewide sales tax.

Does nh tax food. Washington state does levy some income tax but only on investment income and capital gains for people making over a certain amount. 1800 per 31-gallon barrel or 005 per 12-oz can.

A Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Its 9 on sales of prepared and restaurant meals and 10 on alcoholic beverages served in restaurants.

Is food tax exempt in all states. The State of New Hampshire does not have an income tax on an individuals reported W-2 wages. Does nh tax food.

New Hampshire is one of the few states with no statewide sales tax. The State of New Hampshire does not issue Meals and Rooms Rentals Tax. Milk Eggs Fish eg bass flounder cod Crustacean shellfish eg crab lobster shrimp Tree nuts eg almonds walnuts.

A 9 tax is also assessed on motor vehicle rentals. Please note that effective october 1 2021 the meals rentals tax rate is reduced from 9 to 85. Kristi Noem said Wednesday she would not call a special legislative session to have lawmakers consider repealing the states.

New Hampshire does tax income from interest and dividends however. Which states do not tax food. 107 - 340 per gallon or 021 - 067 per 750ml bottle.

Is food tax exempt in all states. These excises include a 9 tax on restaurants and prepared. There are however several specific taxes levied on particular services or products.

The New Hampshire income tax has one. These excises include a 9 tax on. Federal excise tax rates on beer wine and liquor are as follows.

States With The Highest Lowest Tax Rates

Opinion State And Local Taxes Are Worsening Inequality The New York Times

Hungry You Better Also Have An Appetite For Taxes Because Some States Tax Food Purchases Don T Mess With Taxes

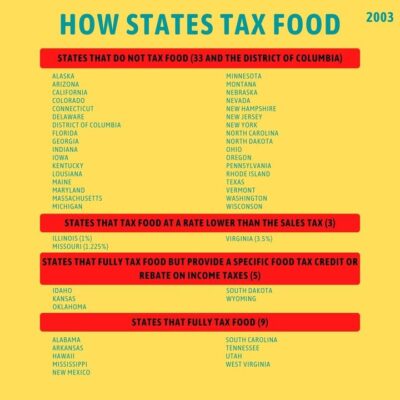

State Sales Tax On Groceries Ff 09 20 2021 Tax Policy Center

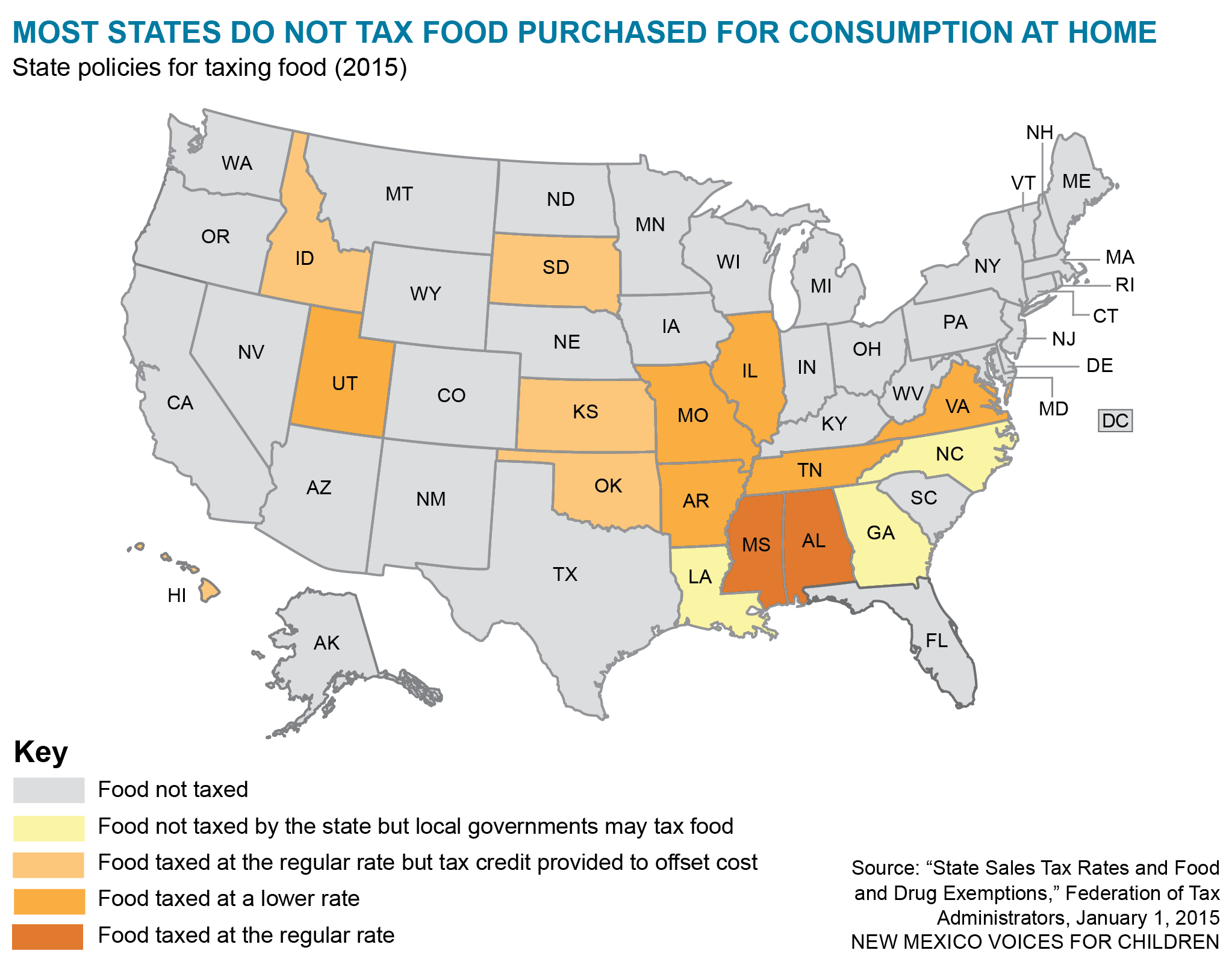

A Health Impact Assessment Of A Food Tax In New Mexico New Mexico Voices For Children

Understanding California S Sales Tax

Hungry For Some Football Watching Food Your Super Bowl Party Budget Better Include Party Snack Taxes Don T Mess With Taxes

9 States With No Income Tax Bankrate

States Have Historic Amounts Of Leftover Cash The Economist

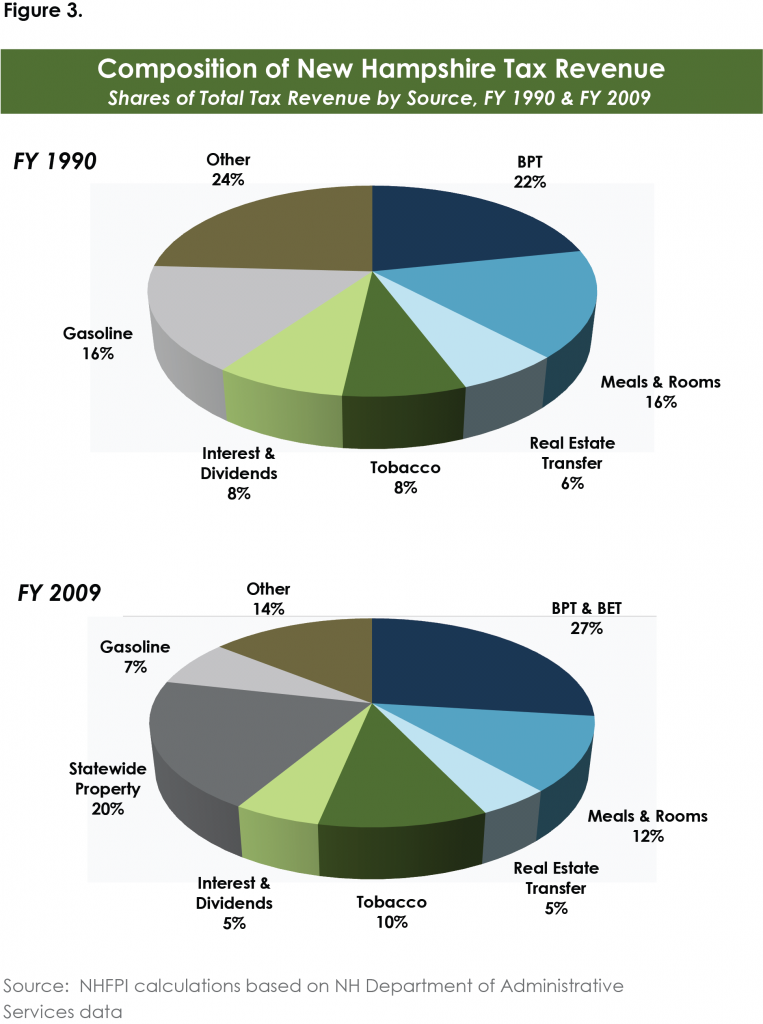

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Arkansas Sales Tax Rate Rates Calculator Avalara

11 Strange State Tax Laws Turbotax Tax Tips Videos

Pdf Do Grocery Food Sales Taxes Cause Food Insecurity Semantic Scholar

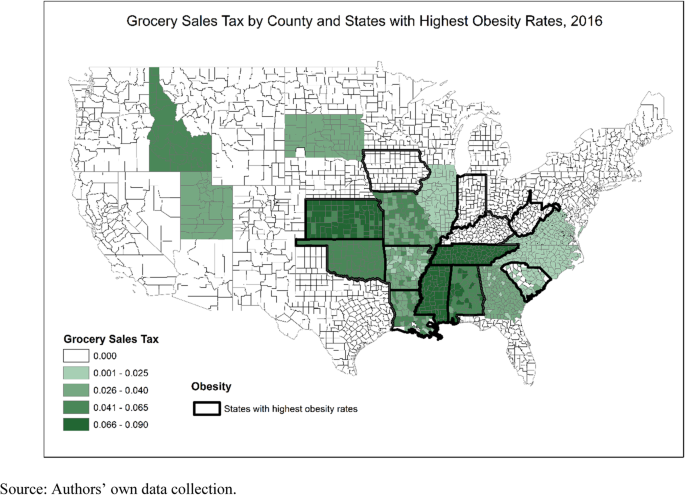

Grocery Food Taxes And U S County Obesity And Diabetes Rates Health Economics Review Full Text

Exemptions From The Washington Sales Tax

Cut To Meals And Rooms Tax Takes Effect Nh Business Review